INCOME PROPERTY FINANCING MARKET UPDATE

June 5, 2019

MARKET UPDATE

The yield curve is inverted, which typically precedes a recession by about 12 months. However, it is now very possible that the FED may lower the Fed Funds Rate, as they clearly over reached with their last increase. Will they, or won’t they? That is the question.

Sales of previously owned homes, which account for about 90% of all home sales, trended lower after peaking in November 2017 through January 2018. In addition, manufacturing activity in the US, Eurozone, Japan, China and the UK slowed considerably from early 2018 through February of this year, and the pace of economic growth slowed substantially from October 2018 to February.

Like late 2008 when the worldwide economic recession was nearing and US stock prices were in the process of bottoming, many experts have predicted that economic growth in major regions of the world will continue to slow and that the US economy will soon enter a recession. Not so fast, several economic indicators suggest the opposite.

- The National Association of Realtors reported that existing home sales rose in February to the highest level since March 2018 and at the sharpest monthly rate since December 2015.

- The US Department of Commerce reported sales of new homes rose in February for the second consecutive month and to the highest level since March 2018. With interest rates declining there is a good chance that home sales will continue to increase in the months ahead.

- The Institute for Supply Management reported that US manufacturing activity accelerated in March, as it also did in Japan, China and the UK.

- Construction spending rose in March for the third consecutive month,

- Auto sales rose in March at the fastest monthly pace since September 2017, and

- The University of Michigan survey of US households reported that the Consumer Confidence Index rose for the second consecutive month to the highest level since October 2018, suggesting that personal spending, which accounts for 68% of the GDP, will continue to increase.

There are is a very interesting situation in process with the FED. The Federal Reserve Board consists of seven Fed governors, who are appointed by the President, approved by the Senate, and who set Fed policy and the Fed Funds Rate. There are presently only five Fed governors because Obama didn’t fill the two current vacancies, believing that Hillary would win and that she would have appointed progressives with very different views than Trumps. This is also critical as incumbent presidents who have controlled the Fed have almost always been reelected. Trump is in the process of filling those two vacant seats, already filled two other vacated seats, and is pushing the Fed to reduce the Fed Fund Rate to keep the economy moving, In light of all of this, I would expect that the Fed will likely reduce rates and we will see the economy continue to improve with long term rates remaining low as long as inflation continues to remain in check.

RECENT CLOSINGS

$35,000,000 118 Room Residence Inn by Marriott Goleta, CA Bank refi

$21,700,000 337,000SF Multi-tenant industrial Texas Life Company

$13,500,000 129,187SF Office Chandler, AZ Life Company

$7,350,000 167,547SF Multi-Tenant Industrial Fountain Valley Life Company

$945,000 12 unit Multifamily Las Vegas Fannie Mae

Q10|WESTCAP / We represent 15 life insurance companies for which we service over $2 billion of all property type income property loans. These relationships that date back 30+ years. We also work with the largest Fannie/Freddie/HUD underwriters in the country in addition to some of the best banks, bridge and CMBS sources, arranging permanent, construction, bridge and mezzanine financing nationwide.

Hospitality Permanent Financing - I have recently seen hospitality quotes of 10-year fixed from a bank with flexible prepay at 1.70 over LIBOR with a hedge which resulted in a fixed rate at 4.12% with IO for 2 years, and a CMBS quote with 10 years IO. CMBS continues to be the source for maximum leverage underwriting senior debt to hi-8%'s to low 9% debt yield with spreads in the mid to low-to-mid 200's over the Swap. I have also received quotes from several that added mezz to get down to 8.5% debt yields using a combined 1.10 DCR. We have also seen spreads as low as 150 for lower leverage loans. 2) Life companies are underwriting hospitality to 12% debt yield with rates in the low to mid 200's over the 10-year Treasury for the right properties and borrowers.

Hospitality Construction Financing - Banks continue to be under pressure to dial back commercial construction lending, particularly on hospitality. That said, I still have several hospitality construction lenders quoting up to 65% LTC for a select service hotel. I also have a couple of banks that provide non-recourse hospitality construction loan up to 75% LTC with a combination 55%-60% senior and mezz for the balance. Finally, we have a great nationwide SBA source which can get to 85% LTC at Prime +2% up to $30 million.

Multifamily Our life companies have been getting creative, offering forward commitments at attractive rates up to 75% LTV, requiring some recourse which are released once DRC hurdles are achieved.

*** We have a very aggressive bank quoting in the high 3%'s for 5, 7 and 10/30, with LTV's to 80% and DCR's as low as 1.15.

I jut closed a 12 unit property in Las Vegas with Fannie at full leverage 10/30, PAR and low processing cost.

We work with a few of the largest Fannie/Freddie underwriters in the country for small and large programs. Multifamily also continues to be a favorite and our life companies have been coming up with some amazing pricing. We continue to see spreads inside of 100 basis points over the 10-year Treasury on large lower leverage loans.

Agency Bridge Loans are available from $2 million at a 1.0 DCR for 2-3 years up to 90% of current value and 80% of stabilized for 1 point in and 1 out (waived if you take their perm) at L+400.

Industrial financing continues to be a favorite as well of all lending sources. Life companies spreads ranged from sub-120-170 depending on leverage. Rates are slightly higher for office, retail, medical office and self-storage.

Office & Medical Office - There is plenty of capital for office and medical office. I have a soft quote on a large single tenant office building in San Francisco for a 15/20 at 65% LTV with no TILC reserves with a 10-year lease.

Unanchored and Strip Retail - Grocer anchored with solid sales figures are still a favorite. We continue to have life company sources for unanchored and strip retail.

Big Box Retail space continues to be difficult due to the difficulty re-leasing these spaces as the retail industry closes and downsizes their retail stores to showrooms while shipping inventory direct to customers from big industrial logistics distribution facilities.

Hospitality Construction Financing - Banks continue to be under pressure to dial back commercial construction lending, particularly on hospitality. That said, I still have several hospitality construction lenders quoting up to 65% LTC for a select service hotel. I also have a couple of banks that provide non-recourse hospitality construction loan up to 75% LTC with a combination 55%-60% senior and mezz for the balance. Finally, we have a great nationwide SBA source which can get to 85% LTC at Prime +2% up to $30 million.

Multifamily Our life companies have been getting creative, offering forward commitments at attractive rates up to 75% LTV, requiring some recourse which are released once DRC hurdles are achieved.

*** We have a very aggressive bank quoting in the high 3%'s for 5, 7 and 10/30, with LTV's to 80% and DCR's as low as 1.15.

I jut closed a 12 unit property in Las Vegas with Fannie at full leverage 10/30, PAR and low processing cost.

We work with a few of the largest Fannie/Freddie underwriters in the country for small and large programs. Multifamily also continues to be a favorite and our life companies have been coming up with some amazing pricing. We continue to see spreads inside of 100 basis points over the 10-year Treasury on large lower leverage loans.

Agency Bridge Loans are available from $2 million at a 1.0 DCR for 2-3 years up to 90% of current value and 80% of stabilized for 1 point in and 1 out (waived if you take their perm) at L+400.

Industrial financing continues to be a favorite as well of all lending sources. Life companies spreads ranged from sub-120-170 depending on leverage. Rates are slightly higher for office, retail, medical office and self-storage.

Office & Medical Office - There is plenty of capital for office and medical office. I have a soft quote on a large single tenant office building in San Francisco for a 15/20 at 65% LTV with no TILC reserves with a 10-year lease.

Unanchored and Strip Retail - Grocer anchored with solid sales figures are still a favorite. We continue to have life company sources for unanchored and strip retail.

Big Box Retail space continues to be difficult due to the difficulty re-leasing these spaces as the retail industry closes and downsizes their retail stores to showrooms while shipping inventory direct to customers from big industrial logistics distribution facilities.

Bridge Lenders - With pressure on the banks to be more conservative many have turned their focus to bridge lending in addition to our traditional bridge lenders and we are seeing several get more aggressive with less recourse and flexible prepayment provisions. On large transactions we are seeing pricing as low as LIBOR plus even sub-200, but again those are very large transactions. For deals under $25 million we are seeing pricing as low as L+300 for multifamily properties and goes up from there. 12-month lock out with no make whole provision and full term I/O and typically 1 point in and 1 point or less out. With the CMBS sources they will usually waive the exit fee if you roll into their permanent program. Some of the CMBS have their own internal mezz which can get them up to 80% LTV.

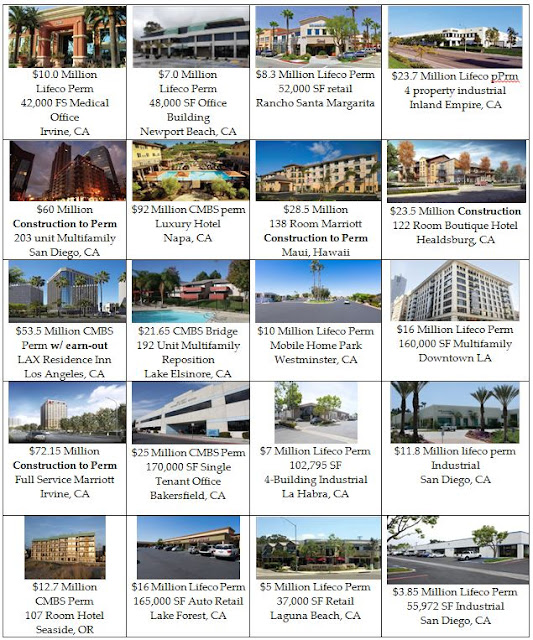

CROSS SECTION OF PAST CLOSINGS

WHY WESTCAP? I have 40+ years experience arranging income property financing, ran 2 major construction lending operations, co-developed over 1 million SF of income property and have managed my own portfolio of retail, medical office and residential income properties since 1978, and have been president of 3 successful mortgage banking companies. I have arranged $600 million of hospitality construction and permanent financing the past 6 years, and I handle all income property types. My focus is solely on arranging the best possible loans for my clients.

WESTCAP was founded in 1988 and serves as a correspondent to 15 life insurance companies for which we service over $2.0 billion. Most of these correspondent relationships date back over 25 years, including Sun Life of Canada for which we have been the exclusive correspondent in Southern California for over 30 years. We also represent non-correspondent life companies, multifamily agency sources, banks, construction lenders, bridge, mezzanine and equity, in order to meet all of our client's financing needs. We handle assignments ranging from $1,000,000 to $400,000,000 nationwide, and represent all sizes of borrowers including many of the largest developers in Southern California.

WESTCAP is also a founding member of Q10, which is a network of 14 of the largest independent mortgage banking companies in the country with 22 offices throughout the United States, and a combined servicing portfolio in excess of $12 Billion. We arranged a combined $4.6 Billion last year, 46% life company, 18% CMBS and 36% agency. With a proprietary database sharing quotes, lender and equity intelligence we are constantly in a position to insure that we deliver the best sources at any given time for our clients.

Call for rates on all income property types including hospitality, multifamily, industrial, office, medical office, self-storage, retail, student and senior housing. We even have a couple of bank sources which offer no prepayment penalty and a few who offer non-recourse. With a few exceptions our permanent lending sources are PAR to us.

Executive Vice President

Q10|WESTCAP

9960 Irvine Center Drive

Irvine, CA 92618

Office: (949) 387-9061 Cell: (949) 235-1540

sbridges@Q10westcap.com

https://www.linkedin.com/in/stevebridges2/

www.westcapcorp.Q10Capital.com

CA RE Broker: 00465840