JUNE 11, 2018

I am pleased to announce the

funding of a $16,250,000 bank construction loan for

a 140-Room Hampton Inn in downtown Riverside, CA.

a 140-Room Hampton Inn in downtown Riverside, CA.

MARKET

UPDATE

The

10-Year Treasury has moved up 46 basis points since the first of the year to

2.96% and the 10-Year Swap has moved up to 3.02%, while the Prime rate has moved

up from 4.25% to 4.75%. A recent increase in bond yields, along with positive

economic data and rising inflation, has boosted expectations that the Federal

Reserve will increase interest rates and tighten monetary policy. The Fed raised

rates in March and is expected to raise rates twice more, with some investors

expecting a third hike. Expectations of higher interest rates tend to

boost the dollar by making the currency more attractive to yield-seeking

investors, while uncertainty over US-China trade talks has the stock market in

flux. Once again, we are seeing the Treasury Yield has drop the past week along

with the price of oil, while the Dollar is at a 10-month high against the Euro

amid the deepening political crisis in Italy.

On May

22nd Congress passed S2155, “Economic Growth Regulatory Relief and

Consumer Protection Act”, aka “the Reform Bill.” The intent of this legislation

was to clarify specific provisions pertaining to HVCRE regulations, as defined

by Basel III and the FDIC. President Trump has indicated he will sign the bill.

The most salient changes are:

1. Developers can, once again, receive credit for the appraised value of contributed land versus the actual purchase price.

2. This new legislation removes restrictions on distributing excess capital above the requisite minimum. Now, only the 15% minimum required capital need remain in the project.

3. If the cash flow generated by the real property is sufficient to support the debt service and expenses of the real property, in accordance with the bank’s applicable loan underwriting criteria for permanent financings, then the loan is no longer required to be classified as HVCRE. Under the old rules, the standing loan would be classified HVCRE until the property is refinanced and the current loan is retired or converted to a permanent status. With regard to construction loans, once substantial completion has occurred and the property’s cash flow is sufficient to cover debt and expenses, then the financing institution has the option of reclassifying the obligation as non-HVCRE.

4. In conclusion, there are no hard and fast rules, and, as always, lending institutions have their own criteria and policies. The recent legislative changes provide additional latitude for increased discretion on the part of lenders.

1. Developers can, once again, receive credit for the appraised value of contributed land versus the actual purchase price.

2. This new legislation removes restrictions on distributing excess capital above the requisite minimum. Now, only the 15% minimum required capital need remain in the project.

3. If the cash flow generated by the real property is sufficient to support the debt service and expenses of the real property, in accordance with the bank’s applicable loan underwriting criteria for permanent financings, then the loan is no longer required to be classified as HVCRE. Under the old rules, the standing loan would be classified HVCRE until the property is refinanced and the current loan is retired or converted to a permanent status. With regard to construction loans, once substantial completion has occurred and the property’s cash flow is sufficient to cover debt and expenses, then the financing institution has the option of reclassifying the obligation as non-HVCRE.

4. In conclusion, there are no hard and fast rules, and, as always, lending institutions have their own criteria and policies. The recent legislative changes provide additional latitude for increased discretion on the part of lenders.

Industrial financing

continues to be the favorite of our life companies with full leverage spreads in

the 130-150 spread range. In addition to 10-year fixed rate financing, we are

seeing several of our life companies offering terms from as short as 3 years all

the way to 30 years fully amortizing. With the yield curve extremely flat the

difference in rate between 7 and 10 year fixed rates vs. a 15 or 20 year fixed

rate is not much if you are interested in a fully amortizing loan. Rates are

slightly higher for office, retail, medical office and

self-storage.

Big Box Retail space continues to be difficult due to the difficulty re-leasing these spaces as the retail industry closes and downsizes their retail stores to showrooms while shipping inventory direct to customers from big industrial logistics distribution facilities. Thus the preferred treatment of industrial property financing.

Big Box Retail space continues to be difficult due to the difficulty re-leasing these spaces as the retail industry closes and downsizes their retail stores to showrooms while shipping inventory direct to customers from big industrial logistics distribution facilities. Thus the preferred treatment of industrial property financing.

Multifamily

financing also continues to be a favorite and our life companies have been

coming up with some amazing pricing. We have actually seen spreads inside of 100

basis points over the 10-year Treasury on large lower leverage loans. The

Agencies (Fannie and Freddie) can get up to 80% LTV are pricing full leverage at

1.25 DCR. Pricing is in the range of 219-229 over the 10-year Treasury on a PAR

basis. The advantage of course with Fannie and Freddie is that they allow for

multiple future loan increases at their then first TD rates. We have some

amazing pricing for Affordable (Low Income) Multifamily

projects.

Agency Bridge Loans are available from $2 million unstabalized at a 1.0 DCR for 2-3 years up to 90% of current value and 80% of stabilized for 1 point in and 1 out (waived if you take their perm) at L+400.Hospitality permanent financing continues to be priced a higher with CMBS continuing to be the source for maximum leverage. Some of our CMBS sources can get down to debt yields in the low to 9% with full leverage spreads in the mid-200’s for 10-year fixed rates, while the life companies look for a minimum of 12% debt yields with spreads in the low 200’s. We also have equity sources which are interested in select and full service with very experienced developers.

Banks continue to be under pressure from the regulators to dial back commercial construction lending, particularly in the case with hospitality construction lending. That said, I just arranged a $16,250,000 hospitality construction loan at 65% LTC for a select service hotel. Most banks are capping their hospitality construction loans at 55%-60% LTC, with several allowing construction mezz up to 75% LTC behind their senior loans.

Agency Bridge Loans are available from $2 million unstabalized at a 1.0 DCR for 2-3 years up to 90% of current value and 80% of stabilized for 1 point in and 1 out (waived if you take their perm) at L+400.Hospitality permanent financing continues to be priced a higher with CMBS continuing to be the source for maximum leverage. Some of our CMBS sources can get down to debt yields in the low to 9% with full leverage spreads in the mid-200’s for 10-year fixed rates, while the life companies look for a minimum of 12% debt yields with spreads in the low 200’s. We also have equity sources which are interested in select and full service with very experienced developers.

Banks continue to be under pressure from the regulators to dial back commercial construction lending, particularly in the case with hospitality construction lending. That said, I just arranged a $16,250,000 hospitality construction loan at 65% LTC for a select service hotel. Most banks are capping their hospitality construction loans at 55%-60% LTC, with several allowing construction mezz up to 75% LTC behind their senior loans.

Bridge Lenders

- With pressure on the banks to be more conservative many

have turned their focus to bridge lending in addition to our traditional bridge

lenders and we are seeing several get more aggressive with less recourse and

flexible prepayment provisions. On large transactions we are seeing pricing as

low as LIBOR plus even sub-200, but again those are very large transactions. For

deals under $25 million we are seeing pricing as low as L+350 for multifamily

properties and goes up from there. 12-month lock

out with no make whole provision and full term I/O and typically 1 point in and

1 point or less out. With the CMBS sources they will usually waive the exit fee

if you roll into their permanent program. Some of the CMBS have their own

internal mezz which can get them up to 80% LTV.

LIFE COMPANY

RATES 5-Year 10-Year

Multifamily * 4.54%-5.10% 4.36%-5.06%

Office, Industrial, Shopping Center and Self-Storage

4.50%-5.20% 4.46%-5.216

*Our life companies are PAR to us, and we have been beating the agencies on interest rates. That situation will likely improve as the likelihood if the agencies are privatized under the new administration.

*Amortizations run up to 30 years depending on the age and condition of the property.

Multifamily * 4.54%-5.10% 4.36%-5.06%

Office, Industrial, Shopping Center and Self-Storage

4.50%-5.20% 4.46%-5.216

*Our life companies are PAR to us, and we have been beating the agencies on interest rates. That situation will likely improve as the likelihood if the agencies are privatized under the new administration.

*Amortizations run up to 30 years depending on the age and condition of the property.

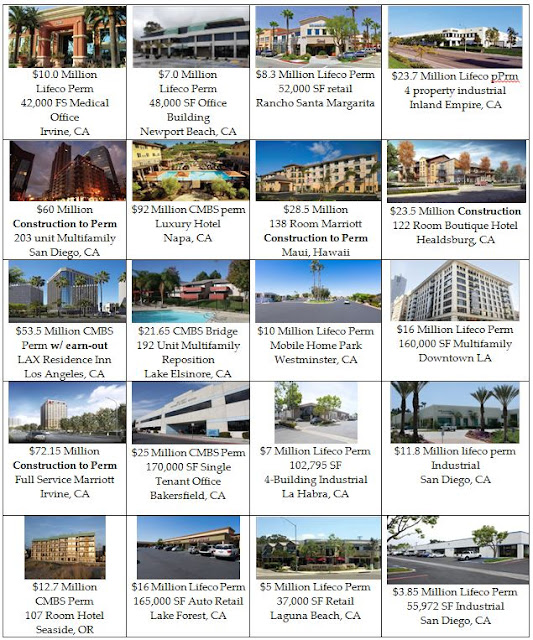

SAMPLING OF

PAST CLOSINGS

WHY

WESTCAP?WESTCAP

is a founding member of Q10 Capital, which was formed in 1988, and is a network

of 14 of the largest independent mortgage banking companies in the country with

22 offices throughout the United States, and a combined servicing portfolio in

excess of $12 Billion. With a proprietary database sharing quotes, lender and

equity intelligence we are constantly in a position to insure that we deliver

the best sources at any given time for our

clients.

WESTCAP serves as a

correspondent to 15 life insurance companies for, which we service over $1.9

billion, and other sources of capital in order to meet all of our

client's financing needs. Most of these correspondent relationships date back

over 25 years, including Sun Life of Canada for which we have been the exclusive

correspondent in Southern California for almost 30 years. We are handling

assignments ranging from $1,000,000 to $400,000,000, and represent all sizes of

borrowers including some of the largest developers in Southern

California.

Call for rates on all income property types including hospitality, self-storage, student and senior housing. In addition to our life company sources, we have a long list of relationships with active CMBS, construction, bridge and mezz lenders and equity for all product types. We even have a couple of bank sources which offer no prepayment penalty and a few who offer non-recourse. With a few exceptions our permanent lending sources are PAR to us.

Call for rates on all income property types including hospitality, self-storage, student and senior housing. In addition to our life company sources, we have a long list of relationships with active CMBS, construction, bridge and mezz lenders and equity for all product types. We even have a couple of bank sources which offer no prepayment penalty and a few who offer non-recourse. With a few exceptions our permanent lending sources are PAR to us.

Steve BridgesExecutive Vice President

Q10|WESTCAP

9960 Irvine Center Drive

Irvine, CA 92618

Office: (949) 387-9061 Cell: (949) 235-1540

Q10|WESTCAP

9960 Irvine Center Drive

Irvine, CA 92618

Office: (949) 387-9061 Cell: (949) 235-1540

EMAIL: sbridges@Q10westcap.com

www.westcapcorp.Q10Capital.com

CA RE Broker: 00465840

CA RE Broker: 00465840